World Liberty Financial (WLFI) – What Investors Need to Know About This DeFi Project

Introduction

The digital asset world moves fast, but few launches in 2025 have generated as much attention as World Liberty Financial (WLFI). With a governance token (WLFI), a U.S. dollar–backed stablecoin (USD1), and even connections to Wall Street via ALT5 Sigma, the project blends DeFi mechanics with mainstream visibility. With a major September 1 token unlock around the corner, investors are asking: What is WLFI really all about?

What Is WLFI?

At its core, WLFI is a DeFi platform that revolves around two tokens working hand in hand:

-

USD1 stablecoin – pegged 1:1 to the U.S. dollar and reportedly backed by U.S. Treasuries and cash.

-

WLFI governance token – used for voting, but also designed to benefit directly from USD1 adoption.

Here’s how the relationship works: reserves behind USD1 generate yield (like interest on Treasuries). Instead of keeping those earnings, the protocol uses them to buy back and burn WLFI tokens. That means the more USD1 is used, the scarcer WLFI becomes over time — potentially giving it long-term deflationary value.

For investors, this is the central pitch: USD1 adoption is the growth engine; WLFI is the ownership layer.

Political and Institutional Connections

WLFI is unusual in that it carries both political and institutional ties:

-

Political angle: The Trump family is heavily linked to the project, with Donald Trump himself holding a large allocation and Eric Trump involved in governance.

-

Institutional angle: WLFI struck a major deal with ALT5 Sigma, a Nasdaq-listed company that now holds WLFI tokens on its balance sheet. This creates a regulated bridge for traditional investors, similar to how MicroStrategy gave Wall Street indirect exposure to Bitcoin.

These connections bring visibility but also scrutiny — something investors need to keep in mind.

The Role of USD1 in the Ecosystem

WLFI isn’t just trying to be another governance token. By tying its fate to USD1, it’s aiming to solve a common DeFi weakness: governance tokens with no real demand.

-

Every USD1 in circulation produces yield.

-

That yield funds WLFI buybacks and burns.

-

The more users and institutions adopt USD1, the stronger the buying pressure on WLFI.

In this way, USD1 acts as the engine that could make WLFI more than just speculative. The stablecoin is what gives WLFI a revenue model and a potential intrinsic value.

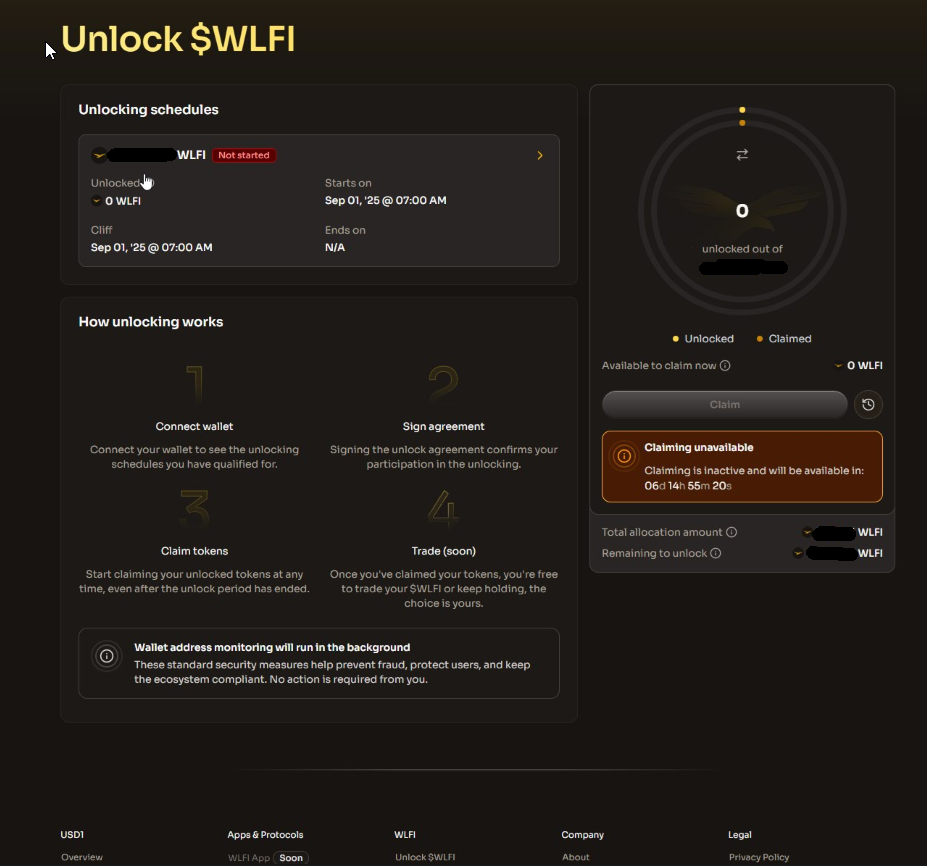

The Upcoming Unlock

The big moment ahead is the September 1, 2025 token unlock. Here’s what’s happening:

-

20% of WLFI supply will be released through the audited Lockbox smart contract.

-

A smaller pre-unlock already freed around 6.55 billion tokens, valued at ~$1.5 billion.

-

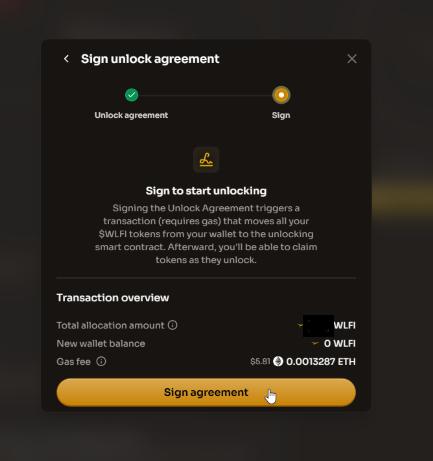

Early presale buyers must activate the Lockbox to claim their tokens.

This event marks the start of real price discovery. Futures have already hinted at a $40B fully diluted valuation, but the unlock will show whether demand — especially from USD1 users — is strong enough to support it.

Opportunities and Risks

Why Investors Are Watching

-

Deflationary design: WLFI buybacks are hardwired into USD1’s growth.

-

Wall Street link: ALT5 Sigma offers a regulated entry point.

-

High visibility: Political and institutional backing ensures media attention.

Where to Be Cautious

-

Concentrated ownership: Insiders hold a large share of WLFI.

-

Unlock volatility: Large supply releases can pressure the market.

-

Regulatory risk: Ties to politics may attract extra oversight.

Final Thoughts

So, what is WLFI all about? It’s an ambitious attempt to merge a stablecoin economy (USD1), a deflationary governance token (WLFI), political branding, and institutional bridges into one ecosystem. The September 1 unlock is the first big test: will WLFI’s design and USD1’s promise of steady revenue flow convince investors, or will the market see it as just another speculative launch?

For now, the key to watch is USD1 adoption. If the stablecoin gains traction, WLFI holders could see real value flow back into the governance token. If not, WLFI risks becoming another hyped token without utility.